Financial Accounts

Top High-Yield Savings Accounts

Discover high-interest accounts that grow your savings faster.

-

Earn interest rates well above the national average without locking up your money

-

No or low monthly maintenance fees with many accounts

-

Easy online access and mobile tools for transfers and account management

-

FDIC-insured (or equivalent) up to $250,000 per depositor

-

Compare minimum deposit requirements, withdrawal limits, and customer features

Top Online Stock Brokers

Start investing with platforms that combine low costs, ease of use, and advanced tools.

-

SoFi Invest — get up to $1,000 in free stock when you fund a new account; fractional shares & commission-free trading

-

Public — start investing with just $1, trade stocks & ETFs, access to fractional shares

-

Robinhood — commission-free trades of stocks, options & ETFs; free stock on account open; access to IPOs

-

Moomoo — trade U.S. & international markets with $0 commissions; earn interest on idle cash

-

The Motley Fool (Broker Recommendations) — expert stock picks, detailed analysis, ETF insights

-

IRA Financial — expand beyond stocks into alternative assets with tax-advantaged accounts

All platforms include no-obligation account checks and trusted trading tools.

Top Crypto Exchanges & Wallets

Buy, trade, and store crypto safely using trusted platforms.

-

Kraken – trade 2,000+ markets, 24/7 support, advanced tools

-

Coinbase – user-friendly, supports 100,000+ crypto assets, wallet + exchange combo

-

Uphold – discover new tokens before others, 300+ digital assets supported

-

ZenGo – wallet with MPC cryptography, 3-factor recovery, in-app support

-

Ledger Nano X – hardware wallet, offline key storage, high security

-

Trezor – secure element chip, supports thousands of coins & wallet apps

-

Gemini – simple trading experience, recurring buys, extensive resources

All these platforms offer trusted security features, easy account setup, and support for active trading or storage.

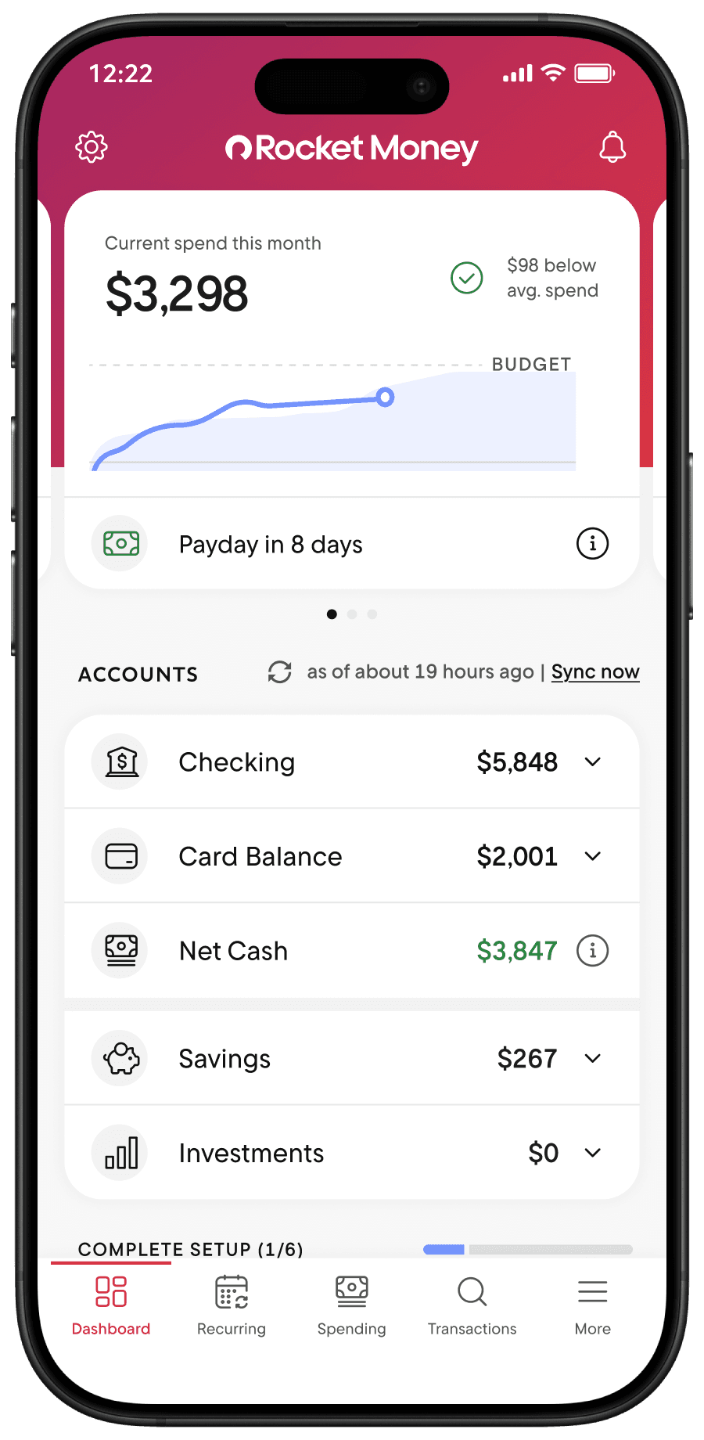

Rocket Money

An all-in-one money app that helps you save more, spend less, and stay ahead of your bills.

-

Finds and cancels unwanted subscriptions automatically

-

Tracks spending across all your accounts in one dashboard

-

Sends alerts for low balances or unusual activity

-

Budgets dynamically and adjusts based on your income/expenses

-

Bill negotiation concierge (in premium version) to lower recurring costs